The Total Overview to Payday Advance: Incorporation, Qualification, and Benefits of Cash Money Advancement

Cash advance work as a fast financial service for immediate expenses, yet they feature certain criteria for incorporation and eligibility. Lots of individuals may not fully understand the requirements or the benefits connected with cash loan. This overview aims to clarify the complexities surrounding payday advance, supplying vital insights into the application procedure and responsible loaning. Recognizing these elements is critical for any person considering this financial alternative. What exists ahead may substantially influence economic choices.

Recognizing Payday Loans: What They Are and Just how They Function

Although lots of individuals might find themselves in unexpected financial demand, payday advance loan provide a quick option that features significant dangers. These short-term, high-interest finances are generally made to cover immediate expenses up until the borrower obtains their following paycheck. The process is usually simple; candidates provide fundamental personal details and proof of revenue, allowing lenders to assess their capability to repay the financing.

Payday advance normally come with steep charges, which can lead to a cycle of financial obligation if debtors are not able to settle the quantity by the due date. Rate of interest can be expensive, sometimes going beyond 400% APR, making these finances among the most expensive types of loaning. Debtors have to be aware of the terms, as failure to pay off can result in more financial difficulties, consisting of additional charges and damages to credit history. Understanding these variables is vital for anyone considering this lending alternative.

Addition Criteria for Payday Loans

To receive a cash advance, applicants usually need to fulfill a number of details criteria established by lending institutions. Largely, people need to go to the very least 18 years old and a resident of the state where they look for the car loan. Evidence of earnings is one more vital demand, typically demanding a steady task or a reputable source of profits to assure loan providers of repayment capacity. On top of that, applicants typically need to supply recognition, such as a driver's certificate or state ID, to confirm their identity. Many loan providers also require candidates to have an energetic monitoring account, helping with the direct down payment of funds and automatic withdrawal upon settlement. While credit report history might not be heavily scrutinized, lenders might carry out a basic check to validate applicants do not have a history of too much defaults. Meeting these inclusion requirements permits people to access the economic assistance that payday advance loan can provide.

Eligibility Needs for Debtors

The qualification requirements for customers looking for payday advance generally consist of particular age and residency standards. Lenders frequently require evidence of revenue to assure that applicants have the methods to pay off the loan. Understanding these demands is crucial for any person considering this kind of economic aid.

Age and Residency Criteria

Eligibility for payday advance loan usually calls for consumers to meet certain age and residency criteria. The majority of loan providers stipulate that candidates have to go to least 18 years of ages, as this is the lawful age for entering into binding contracts in lots of territories. This demand assures that consumers possess the maturity and obligation necessary for monetary responsibilities.

Furthermore, residency plays an essential duty in qualification. Borrowers are typically needed to be locals of the state where they are requesting a finance, as payday lending regulations can differ considerably by area. Some loan providers might additionally request for proof of residency, such as an utility bill or lease contract, to verify the candidate's address. Satisfying these requirements is crucial for successful loan authorization.

Revenue Verification Refine

While numerous lenders analyze a customer's credit report, income confirmation is a crucial part of the cash advance application procedure. Lenders usually need evidence of earnings to review a customer's capability to pay back the financing. This can include recent pay stubs, bank statements, or income tax return. The income verification process assurances that borrowers have a steady source of income, which is crucial for prompt repayment. Furthermore, lenders might set minimal revenue limits to identify eligibility. Self-employed people might need to provide added documentation, such as revenue and loss statements. By confirming revenue, lenders aim to mitigate danger and assurance that borrowers can manage their capital properly, inevitably fostering a healthier borrowing environment.

The Application Refine for Cash Advance Loans

How does one navigate the application process for payday advance? The procedure typically begins with selecting a trusted lending institution, either online or at a physical area. Applicants have to give personal information, consisting of identification, proof of revenue, and financial details. This details permits the lending institution to evaluate qualification and confirm revenue, which is vital for the loan approval process.

When the application is sent, the loan provider assesses the info, frequently within a brief time frame, sometimes even within minutes. If authorized, the borrower will obtain a financing deal detailing the quantity, terms, and repayment conditions.

After consenting to the terms, the customer indications the agreement, and the funds are typically transferred straight into their savings account. It is crucial for try this site candidates to check out the small print to comprehend the obligations involved. In general, the application procedure is made to be simple, guaranteeing fast access to funds for those in requirement.

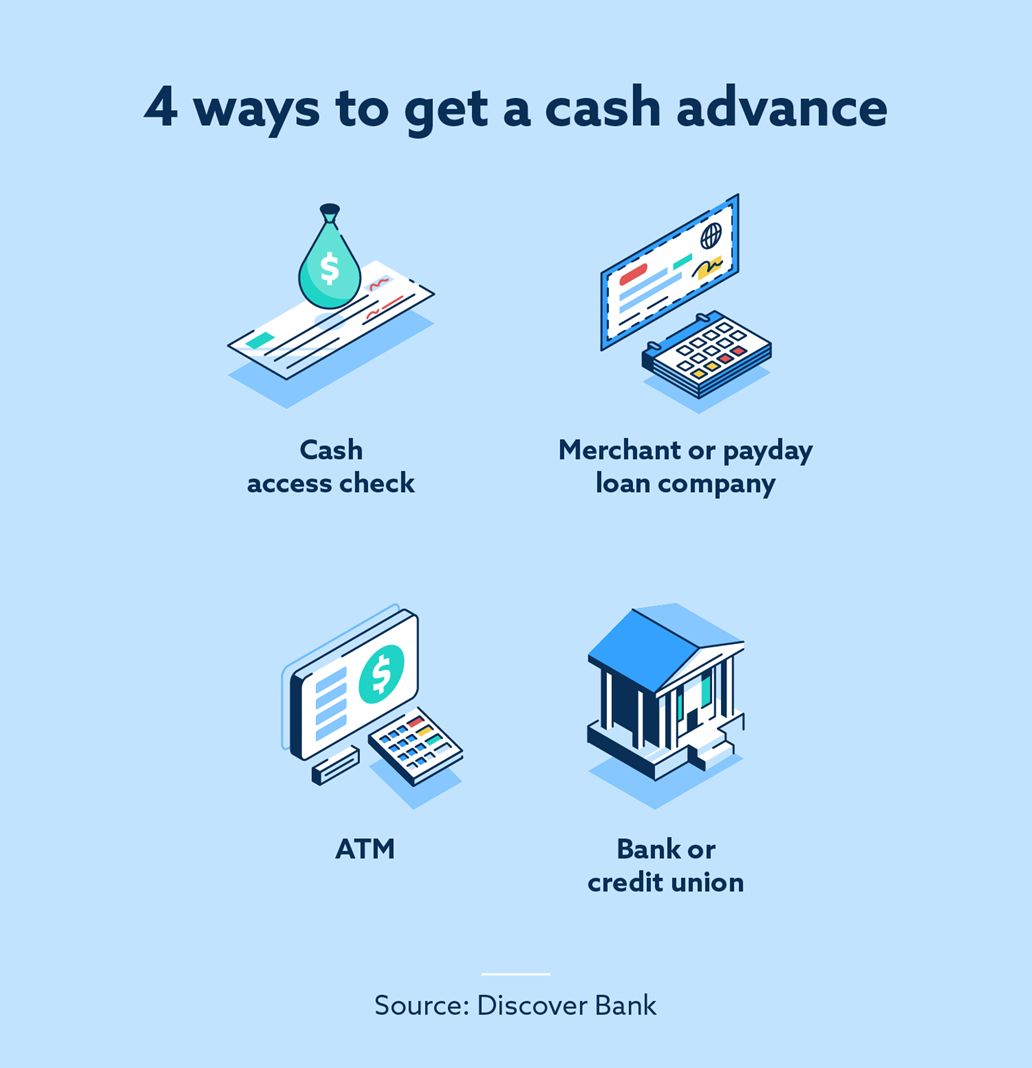

Benefits of Cash Loan

Cash loan provide a convenient service for individuals facing unexpected financial demands. These short-term loans give quick access to funds, usually within a single service day, allowing borrowers to attend to immediate costs such as medical expenses or vehicle repair services. The application process is usually uncomplicated, needing minimal paperwork, which improves access to this content money for those in a pinch.

One more significant advantage is the adaptable settlement options. Customers can frequently choose a repayment schedule that aligns with their economic scenario. Fast Cash. Additionally, cash loan can work as a monetary bridge until the next paycheck, assisting individuals avoid late charges or service charges that might develop from accounts payable

Moreover, cash advances can be valuable for those with minimal credit report, as several loan providers focus much more on earnings and work condition than credit rating. This availability makes cash developments a feasible option for a diverse variety of customers facing temporary financial obstacles.

Tips for Liable Borrowing

Recognizing the advantages of cash loan is necessary, however accountable loaning techniques are just as necessary to guarantee economic stability. To begin, customers must assess their economic scenario honestly, guaranteeing they can pay back the finance on schedule. Developing a budget plan can aid track costs and identify areas where cuts can be made to accommodate lending settlements.

In addition, consumers must prevent taking out multiple payday advance at the same time, as this can bring about a cycle of financial debt that is challenging to leave. They ought to likewise be aware of the finance terms, including rates of interest and fees, to stop unexpected costs.

Seeking options to payday finances, such as credit scores unions or personal lendings with lower rate of interest prices, can provide more lasting monetary options. By adhering to these suggestions, people can browse cash loan properly, Continue ensuring their financial health stays intact while meeting prompt needs.

Frequently Asked Inquiries

Can I Get a Payday Advance Loan With Bad Credit Rating?

Yes, people with bad credit history can typically get payday loans. Lenders frequently consider earnings and work standing more than credit rating, making these fundings obtainable regardless of lower credit report, albeit normally with higher rates of interest.

For how long Does It Require To Obtain Funds?

Normally, funds from a payday advance are received within one business day after approval. Nonetheless, some loan providers may supply instantaneous transfers, allowing debtors to access their cash within hours, relying on the bank's handling times.

What Takes place if I Miss a Payment?

If a repayment is missed out on, late costs might accumulate, and the lending institution might report the missed settlement to credit scores bureaus. This can adversely influence the debtor's credit rating score and bring about more collection activities.

Are There Any Concealed Fees With Cash Advance Loans?

Payday advance typically feature concealed charges, such as origination charges, late payment costs, and prepayment penalties. Borrowers must meticulously examine funding contracts to recognize all potential costs prior to committing to a payday advance loan.

Can I Surrender My Cash Advance?

Yes, individuals can commonly roll over their payday advance loan, expanding the repayment duration. Nevertheless, this may sustain extra costs and increase total financial obligation, making it vital to consider the long-term implications prior to proceeding.

Payday finances typically come with high costs, which can lead to a cycle of financial obligation if borrowers are unable to settle the amount by the due day. The qualification requirements for debtors seeking payday fundings usually consist of specific age and residency requirements. Eligibility for payday loans normally calls for borrowers to satisfy details age and residency standards - Fast Cash. While several lenders evaluate a consumer's credit scores history, income verification is a necessary part of the payday car loan application process. Seeking choices to payday financings, such as credit unions or individual finances with reduced passion rates, can offer even more sustainable financial services